Hedging can be performed by using different derivatives. The first method is by using hedging with futures. Both producers and end-users can use futures to protect themselves against adverse price movements. They offset their price risk by obtaining a futures contract on a futures exchange, hereby securing themselves of a pre-determined price for their product. An important factor in determining the eventual price, is the basis. The basis is calculated by deducting the futures price form the spot price. By successfully predicting the basis of a commodity, the eventual price of a commodity can be calculated at the moment the hedge is placed. Hedging with futures can be done by long hedging or short hedging.

Long hedging

End-users take a long position when they are hedging their price risks. By buying a futures contract, they agree to buy a commodity at some point in the future. These contracts are rarely executed, but are mostly offset before their maturity date. Offsetting a position is done by obtaining an equal opposite on the futures market on your current futures position. The profit or loss made on this transaction is then settled with the spot price, where the producer will buy his commodity.

The following example explains the execution of a long hedge.

A producer expects to need a wheat delivery in March. In October he purchases an April Wheat contract to cover his price risk on the spot market in March, when he plans to buy the wheat. He predicts the basis to be – $ 0,30 which means the April futures price will be 30 cents higher than the March cash price. the producer can now calculate the expected purchase price for the commodity, using the following formula:

Futures price – Basis + broker commission = Net Purchasing price

The following calculation gives a view of the realization of the purchasing price:

$ 3,50 – $ 0,30 + $ 0,01 = 3,21

Date Futures market Spot Market Basis

March Bought October $ 3,50

Sold March $ 4,60

Futures profit $ 1,10

Broker Commission -$0,01

Net Futures profit $ 1,09 Buys wheat on spot market

Spot Price $ 4,30

Futures profit – $1,09

Net purchasing price $ 3,21

– $ 0,30

This demonstrates the effect of successful hedging. Should the producer have decided not to hedge he would have been forced to pay the spot price of $ 4,30, instead he can purchase the commodity for $ 3,21.

Short hedging

Producers of commodities take a short position when hedging their price risks. They sell their product using a futures contract, for a delivery somewhere later in the future. They hedge their price risk similar to long hedgers. They sell a futures contract, which they offset come the maturity date by buying a equal futures contract. The profit or loss made by offsetting the position is then settled with the price obtained at the spot market. This will be the actual price the producer has obtained for selling their product. Just like a long hedge, the prediction of the basis is a crucial factor for determining the price a producer will receive before hedging the commodity. This price can be calculated using the following formula:

Futures price + basis – broker commission = net selling price.

Source: wallstreetmojo.com

Agiblocks CTRM solution

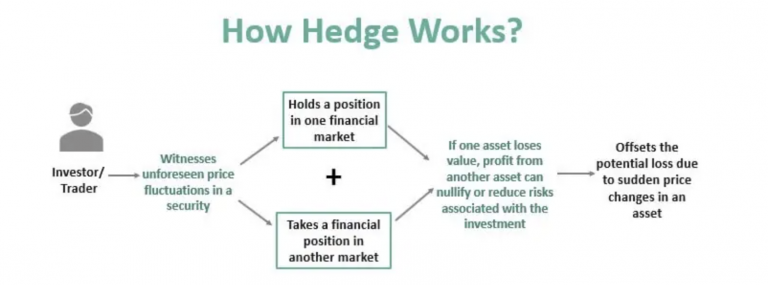

Commodity traders – as well as most other traders – tend to be risk averse. That is to say, they prefer situations with low uncertainty over situations with high uncertainty. Or better yet, no uncertainty at all. However, in economics and finance, as well as in life, things are never one hundred percent certain, nor do the most certain outcomes yield the best results.

Luckily, there are tons of tools to deal with uncertainty as a solution to your risk aversion. And all of them – including hedging with futures – can be wielded from the comfort of your Agiblocks dashboard. Because it is not just the next generation of CTRM systems, but a solution that truly meets all technical as well as business needs for anyone working in soft or agricultural commodities. That’s why anyone looking for CTRM software for the commodity trade – whether you are a trader, buyer or seller dealing with single or multiple soft and/or agricultural commodities – should look no further.

Request a live demo if you are:

- a trader in soft and/or agricultural commodities;

- a buyer or importer of soft and/or agricultural commodities (for instance a producer purchasing raw materials);

- a seller of soft and/or agricultural commodities.

…or if you are simply interested in our next-generation CTRM solution.