After the P of Price feeds comes the P of Profit and Loss (P&L). Which in the agricultural commodity trade – as opposed to the alphabet – comes after the P of Position Management. After all, position management goes hand in hand with financial outcomes. Agiblocks includes a mark-to-market view that considers all assets, including physical commodities, inventory, derivatives such as options and futures, and OTC contracts. This functionality allows traders to quickly assess their overall unrealized profit and loss (P&L), grouped by commodity or even by counterparty.

In our previous entry on price feeds, we talked a lot about futures trading. Let’s do that again to offer a practical example here as well. In futures trading, as in all finance, P&L stands for profit and loss, and it measures how much money a trader gains or loses based on changes in the market price of the contract after it’s been bought or sold.

When you enter a futures contract, you’re agreeing to either buy or sell a certain amount of a commodity (like coffee) at a specific price on a future date. But the actual price of that commodity will change day by day (and throughout the trading day) based on market conditions.

Those price changes are where your P&L comes from.

Here’s how it works: every trading day, the exchange calculates the new value of your open position using that day’s closing price (called the settlement price). The difference between your entry price and the new settlement price determines how much money you’ve made or lost — and this is recorded daily in a process called mark-to-market. If the price moves in your favor, you have an unrealized profit. If it moves against you, you have an unrealized loss. Each day, gains are added to your account and losses are subtracted. If losses become too large, you might be asked to add more money to your account (a margin cal)l.

Back to coffee

Let’s say you’re a trader or a coffee producer, and you sell one Arabica coffee futures contract at $1.85 per pound. Each contract represents 37,500 pounds of coffee.

A week later, the price drops to $1.78 per pound.

Since you sold the contract at a higher price and the market has gone down, you made a profit. Here’s the math:

- Entry price: $1.85

- New price: $1.78

- Difference: $0.07 per pound

- Profit = $0.07 × 37,500 = $2,625

This $2,625 would be credited to your trading account, usually on the same day, through the mark-to-market process.

Now flip the situation. Suppose instead of selling, you bought the futures contract at $1.85, expecting the price to rise — but instead it dropped to $1.78. That $0.07 drop would now be a loss, and you’d owe $2,625. If you didn’t have enough cash in your margin account, your broker would issue a margin call, asking you to deposit more funds to cover the shortfall.

Why P&L matters

P&L is what futures trading is all about — it tells you how well your positions are doing. Traders use it to make decisions: whether to hold, close, or reverse a position. Farmers or buyers use it to assess how effective their hedging strategy is. Financial firms track it daily to manage risk and capital requirements.

It’s important to remember that P&L is not just settled at the end when the contract expires. It’s calculated and settled every single trading day, making futures trading highly liquid but also fast-moving and potentially risky.

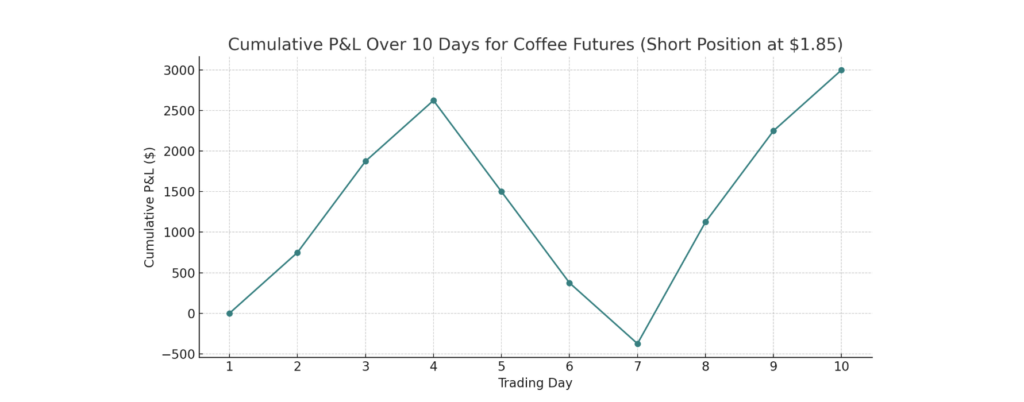

Futures contract – short

Here’s a 10-day simulation of P&L for a short position in coffee futures, entered at $1.85 per pound. Since you’re short, you profit when the price goes down.

On Day 1, the price is flat at $1.85 — no profit or loss yet.

By Day 4, the price has fallen to $1.78, giving a cumulative profit of $2,625.

The market then fluctuates. On Day 7, prices spike briefly above your entry point, leading to a small loss of $375.

By Day 10, the price drops to $1.77, giving you a final profit of $3,000.

This shows how daily market movements can cause your position’s value to rise and fall — even if you’re ultimately right about the trend.

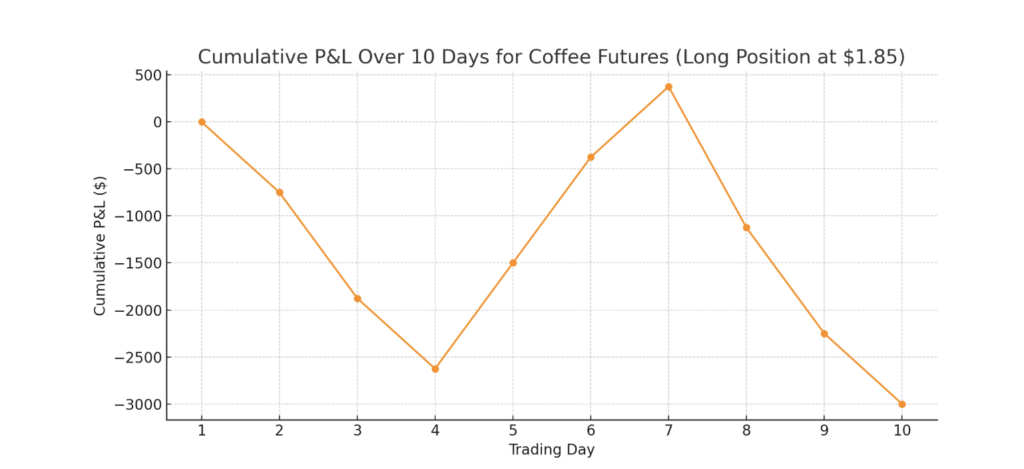

Futures contract – long

Here’s the 10-day P&L for a long position in coffee futures, entered at $1.85 per pound. In this case, you’re buying with the hope that prices will rise.

On Day 1, the price matches your entry, so there’s no gain or loss.

As the price declines over the next few days, your position starts losing money, reaching a loss of $2,625 by Day 4.

There’s a brief recovery on Day 7 when prices rise to $1.86, giving a small profit of $375.

But by Day 10, the price has dropped to $1.77, resulting in a final loss of $3,000.

This shows the daily impact of market movements and how even temporary rebounds don’t always save a losing trade if the broader trend is against you.

Agiblocks

In Agiblocks, we offer both unrealised and realised P&L. Experience our flagship CTRM software solution by getting a front-row seat to all the benefits Agiblocks has to offer with our free demo. The full range of Agiblocks functionality is available in easy to consume videos for your viewing leisure here.

Familiarize yourself with the tools and features of our powerful, agile software solution and find out how you can make the daily practices of commodity trade and risk management for your business more efficient. Fill out the form at agiboo.com/demo and we’ll get back to you!