If you are looking to reduce the price and market risk of your product, but there is no future market available, you might consider a cross hedge. This strategy involves two steps: choosing a proxy commodity and adapting the product to the proxy commodity. Let’s take a closer look at how it works.

Step 1: Choosing a Proxy Commodity

Suppose you want to hedge sweet corn, but there is no future market available for it. In this case, you can choose a proxy commodity to protect yourself against a price fall. For example, you could use the future market for feed corn as your proxy commodity.

Step 2: Adapting the Product to the Proxy Commodity

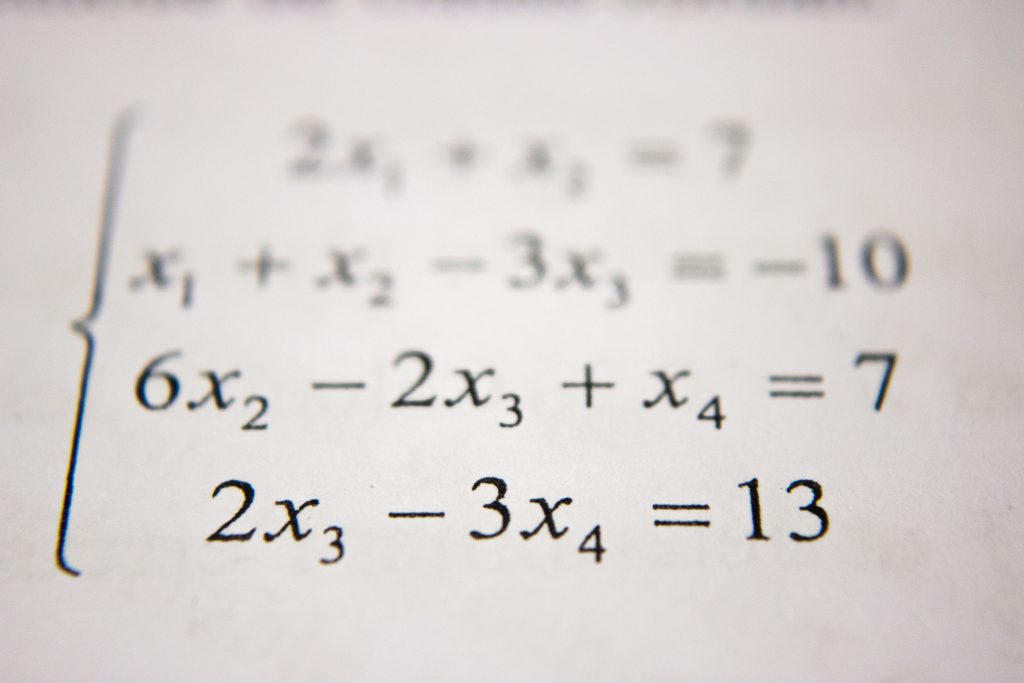

To execute a cross hedge, you will need to sell N futures with the size of Q MT to mature at time 1, and the futures price multiplies at time 0 with Q (the size of the contract). The key challenge is determining how many futures you require of the proxy commodity. This is where math comes in handy.

The math

Let’s say that S1(x) is the cash spot price of feed corn at time 1, and F1,1 is the futures price of feed corn at time 1 for delivery at time 1. Selling the required quantity C in MT on the cash spot price gives S1 x C dollars. The difference between the futures price gives:

- N[F1,1 – F0,1] x Q dollars

At maturity, the futures price converges to the spot price, which makes:

- N[S1(feed corn) – – F0,1] x Q dollars

So that the value of the portfolio becomes:

- S1(organic sweet corn) – N[S1(feed corn) – F0,1] Q

This value can be divided by C and defines the hedge ratio β = NQ/C.

- S1(organic sweet corn) – β[S1(feed corn) – F0,1]

Now, the goal is to minimize the variance of the equation by choosing β in a way that makes:

- Var(S1(organic sweet corn) – 2βCov[S1(organic sweet corn), S1(feed corn)) + β2 Var(S1(feed corn))

When we isolate β, it becomes:

- Β = Cov[S1(organic sweet corn), S1(feed corn)] / Var(S1(feed corn))

Once we have determined β, we can calculate the optimum number of contracts (N) by using the following formula:

N = β (C/Q)

Cross hedge as a risk management tool

Cross hedge can be a useful tool to manage risk when dealing with products that are less common in futures markets. By choosing a proxy commodity and adapting the product to it, you can protect yourself against price fluctuations and market volatility. While the math involved can be complex, the payoff in terms of risk reduction can be significant.

In conclusion, if you are looking to reduce price and market risk for a product without a future market, consider using a cross hedge strategy. By choosing a proxy commodity and adapting the product to it, you can manage risk and protect your investment. Remember, the key to success is in understanding the math behind it and using it to your advantage.