EUROS 2024: Orange fever at Agiboo – now turned into ‘It’s coming home’ chants

It’s been an exciting couple of weeks at Agiboo as we’re gearing up for the final of the Euros at the Olympiastadion in Berlin this Sunday. As an international company, […]

Identifying opportunities in grain trading – Agiboo @ Global Grain Geneva

We’re gearing up for the 22nd annual Global Grains Conference, which will -as always- be held in Geneva. This year’s show is scheduled for November 7-9 and we’re very much […]

Agiblocks 4.0 tutorial in Spanish, part 2 of 2 has arrived!

We’ve recently shared our practical introductory tutorial – or rather video masterclass – for Agiblocks 4.0, the latest version of our flagship CTRM software. As it was only the first […]

Beginner’s Guide to CTRM Software: streamline commodity trading operations

In today’s fast-paced commodity trading industry, efficient management of trading operations is crucial for success. That’s where Commodity Trading and Risk Management (CTRM) software comes into play. This beginner’s guide […]

Now available: CTRM Software – An Analyst View of a Dynamic Software Market

Exciting times at Agiboo. We’re currently gearing up for ‘Agiblocks 4.0’, which we’ll be addressing in a lot more detail somewhere in the coming month – so stay tuned! For now, […]

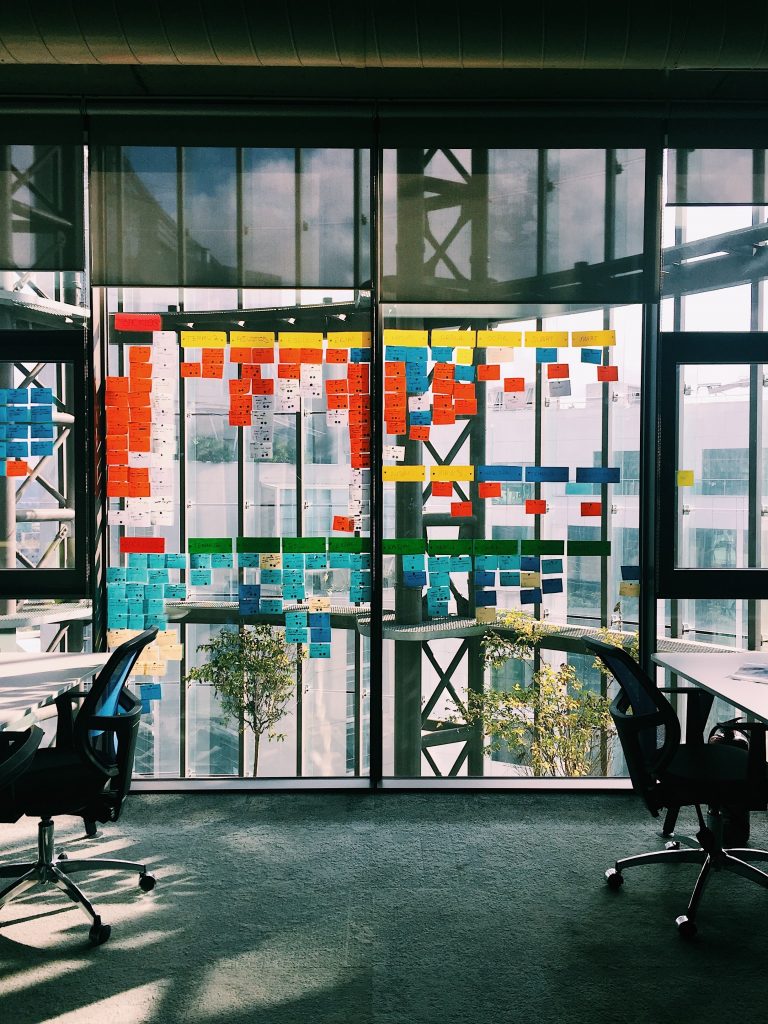

Why scrum is important in CTRM software development

Scrum framework has long since become an essential requirement for managing complex projects and daily functions in any business environment. At Agiboo, we embrace the virtues as well. Which is […]