Willie Sutton, an American bank robber was asked: ‘why do you rob banks?’. His famous answer was: ‘Because that’s where the money is’. This quote evolved even in Sutton’s law. Here you should first conduct those tests which could confirm or rule out the most likely diagnosis. Although he attempted to rob the Corn Exchange Bank. That is not where the relation with Commodity Trade and Risk Management (CTRM) is. For me this relation is where to focus on and how to measure risk in commodity trade. A popular method is Value at Risk (VaR), but what is exactly the Value of Value at Risk?

Risk metrics

What methods do you actually have when you are a risk manager or responsible for a commodity trade operation? Sure you have your crucial reports such as position and Mark to Market. These should answer basically: Are we hedged or not? and it should provide a value of the portfolio when it is sold at market conditions. To be able to answer such questions is pretty crucial but often proves to be a real challenge. Let us assume that we know the answers. What then to measure and report about the assets which are prone to volatility and cannot be completely hedged because of practical reasons?

Such situation occurs more often than anticipated and there can be multiple practical reasons. Timing is one of them but also a non-liquid character of derivative markets or just simply the basis risk involved. The challenge and impact becomes more obvious when a portfolio is growing and getting more versatile as a result of using a variety of hedging instruments. How will you measure risk and get information which allows for quick assessments on where the risk originates from? Personally I find the generally used toolsets and methods available pretty limited. It is in my opinion strange that after multiple decades research, even forced by regulations we didn’t came up with a wide proper toolbox to help the risk manager. Let me share what we do have.

Risk metric tools

The most prominent tools outside Position Reporting and Mark to Market valuation are What-if Analysis and Value at Risk. What-if Analysis is mostly implemented in the form of what the profit and loss or cashflow would do when market prices change. Although indicative maybe, it doesn’t give you a real answer about your risk. Value at Risk is mentioned by many, but in the commodity industry, as far i’m aware only few implemented it effectively and successfully. There is a reason for which Value at Risk is perceived too complex to get it into place. This has everything to do with valuation of the instruments it-selves. When VaR is implemented the usage of it is relative simple.

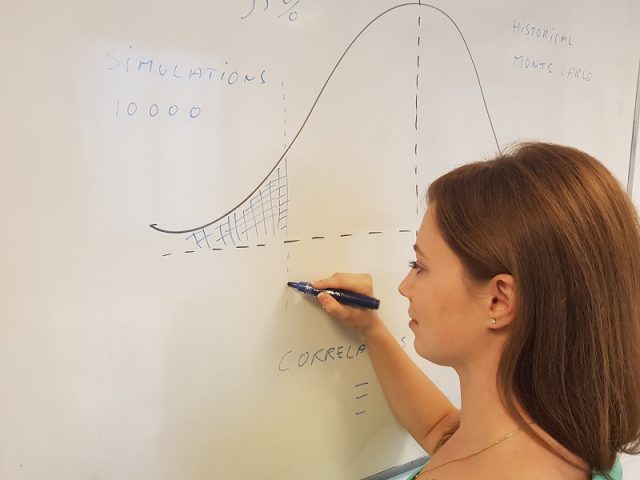

What is Value at Risk? It is a statistical risk measure and actually addresses an amount of money at risk. This amount is the highest possible loss on the P&L over a certain amount of time, considering a certain probability. An example: Tomorrow within a 95% probability range the VaR is 720.000 USD. It is a kind of a worst case scenario. You put all you traded assets in a model which calculates possible cases (Monte Carlo Simulation) or you simulate it against historical occurrences. Monte Carlo simulation is similar to throwing a dice; a calculation of probability. The VaR principles are simple, the challenge lies in the underlying valuation of the assets in the trading portfolio also referred to as portfolio mapping. Valuation, was that not the Market to Market? Yes absolutely. For this reason I recommend not to start with VaR measurement when M2M is still a challenge. When you have a proper M2M calculating VaR is not far away.

Implementing VaR

Is it that simple? Well beside all kind of technicalities such as correlation between the different assets, it is. Still you can debate what the Value of Value of Risk is. Some will say that it doesn’t matter as Black Swans can appear anytime. There is indeed a probability for a Royal Flush in the hand against you, but at the table you will find that reality will always be different, and can you afford to have that happened ? Some will say that VaR only makes sense in combination with P&L movement analysis, detailing the source of variation, identifying different factors for risk and their mutual impact. We acknowledge that the more risk metrics you have, the more grip you will get on it. Probably there is the value of VaR. It is the combination of risk indicators which is helpful, not the VaR number alone. In my experience in commodities statistics have limitations, fundamental and/or geo political events might have impact that overpowers the laws of statistics, therefore my recommendation is to focus first on the most obvious sources of risk, meaning understanding the trading position and M2M as Sutton’s law is dictating. A CTRM solution like Agiblocks might be able to support you with that and evolve after that to more risk indicators such as VaR to benefit from the value.