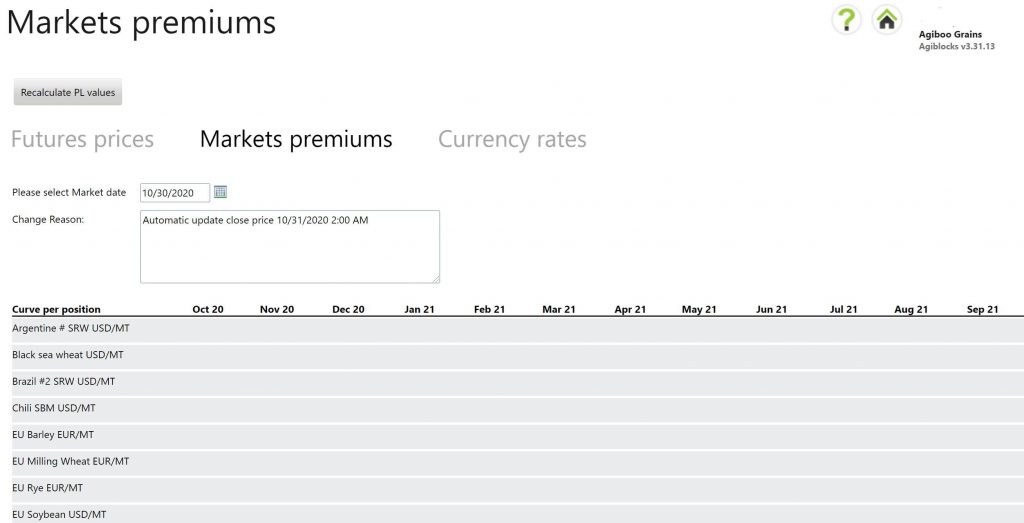

We’ve been talking to the AgFlow team and have some exciting partnership news to share that will further improve the solutions both AgFlow and Agiboo offer to risk managers in agricultural commodities. We’ve discovered that the completely unique market differentials they provide through their recently launched RiskMgmt API can be very useful indeed for our clients, as it concerns valuable data generally entered manually into Agiblocks CTRM. In addition, the technologies are very similar within the same vertical industry of agricultural commodities. Long story short: we decided to partner up, so that we can refer our clients to AgFlow if they like their market premiums automated.

Do you want to know more?

Perfectly Complementary

AgFlow started out in 2013 and was initially focused on cash prices. They have since procured many private data sources, all of them transparent and including over 100 brokers. In expanding the ever-growing database to include import-export flows, freight indications and complete cash forward curves the company has over the years been very successful in establishing a completely singular position as a data supplier in the world of agricultural commodities – especially with the launch of their RiskMgmt API last spring.

“We’ve entered into risk management on the back of our expansive database of differentials and flat prices”, says James Matthews, Head of Growth at AgFlow. “Input for the model is based on our historic database and accounts for trends, seasonality and other developments to offer complete forward curves for the coming 12 months, updated daily.”

“Traders don’t have worry about picking and collecting data, which can easily account for 20 percent of their daily operations. It fits nicely into Agiblocks, so that traders don’t have to run around looking for future prices – because we can provide all of it. Over 100 cash forward curves across 75 Grains, Oilseeds, and Vegoils delivered directly into your system.”

AgFlow’s RiskMgmt API 101

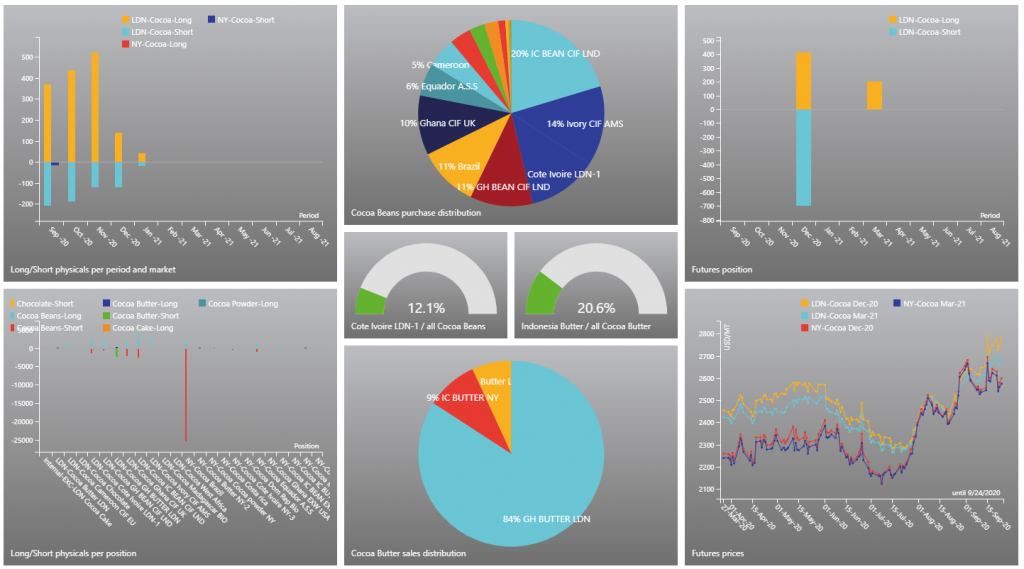

With AgFlow’s RiskMgmt API product, risk managers can access complete one-year cash forward curves for both bid and ask prices to adequately mark-to-market their trading portfolio and correctly assess their Value-at-Risk (VaR). AgFlow’s solution removes all the hurdles faced when working with incomplete cash forward curves. You do not have to collect data from multiple sources, or have to worry about computational resources, while at the same time reducing the risk of introducing errors in analyses through manual input.

Thanks to Risk Mgmt API, you know the value of what is in your books and can easily bridge the information asymmetry between trading and risk management. You can accelerate your mark-to-market, VaR and P&L calculations, because the data is ready for you to plug and play. And you add accuracy and power to your risk management reporting using independent, unbiased, reliable and backtested data. Through the API you can access all the latest market differentials on Corn, Soybeans, Wheats and over 75 more commodities, including completely unique 12-month cash forward curves. “We empower agricultural commodities buyers, sellers, risk managers, investors and movers with accurate, clean and privileged data from unbiased sources. It saves you time and money, while increasing efficiency, productivity and competitivity.”

In other words, do you wish to forget about going through dozens of market reports, digging into hundreds of emails and spending hours on the phone – every day? Weeding out irrelevant data points, cleaning and structuring raw data into something useful? Then AgFlow’s RiskMgmt API might be the solution for you. It helps cutting down on all of your multiple subscriptions to data providers to boot.

Agiboo’s Agiblocks CTRM solutions 101

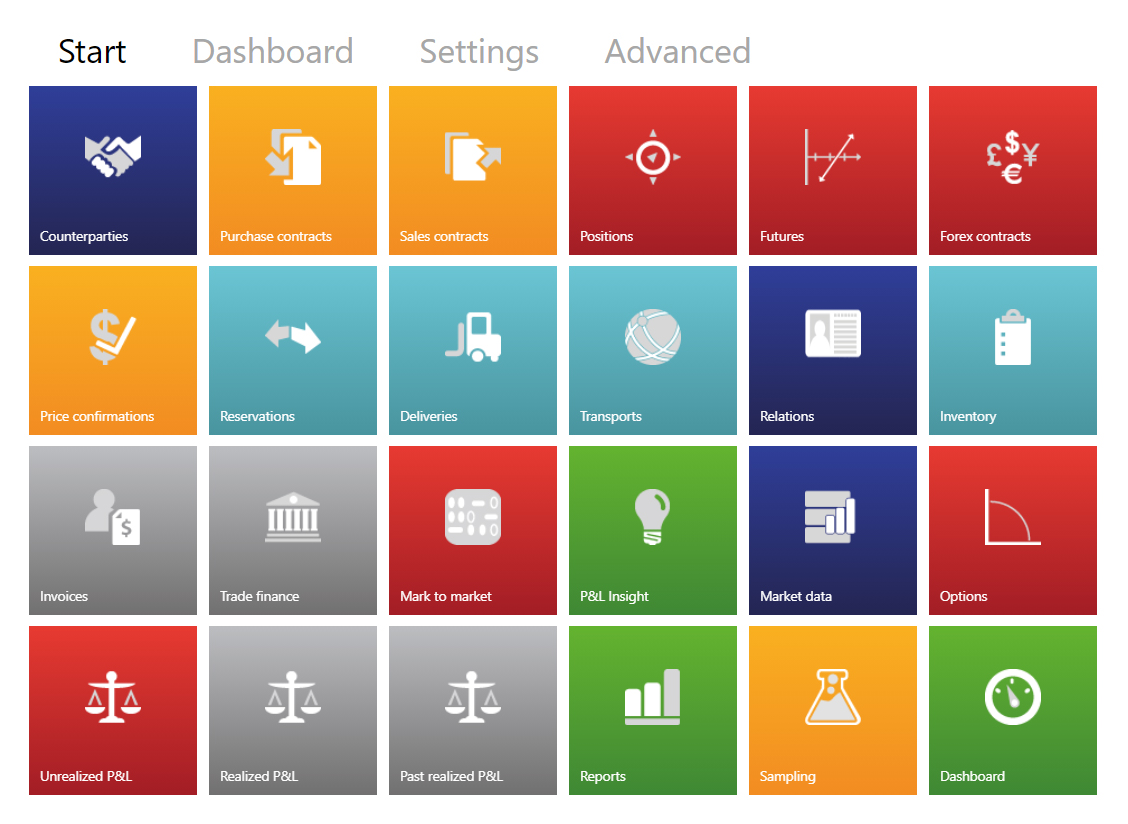

Agiblocks is the first CTRM software solution that simplifies the daily practices of commodity trade professionals. It has been developed with the single goal of making your fixed routine of commodity trading and risk management more efficient. Its clean user interface is simple with fast access to key functions. For every task, from creating a contract to evaluating your risk, all required information is readily available.

“Agiblocks is not just the next generation of CTRM systems, but a solution that truly meets all technical as well as business needs for anyone working in soft or agricultural commodities”, says Jan van den Brom, Managing Partner of Agiboo. “It is rich in functionalities and supports all the flexibility that characterizes the industry, specialized for a certain commodity or commodity group. It is as powerful on smartphones and tablet computers as it is on the desktop, so it’s accessible anytime, anywhere.”

“Furthermore, as of January 2021 it will offer per-transaction prices. That will instantly open the door for all kinds of smaller businesses. For example, if your company has two transactions a week, but you still need a full CTRM solution, that’s all you’re going to have to pay to use Agiblocks. I don’t know of any other company that offers the same model.”

Better data means better decision-making

Agiblocks provides detailed features and functions, in many cases specialized for a certain commodity or commodity group, because capturing all underlying details is simply a necessity for success. “At Agiboo we know you need to have all the relevant data, and it needs to be reliable so you can respond to the real situation. It needs to be supported by quality mechanisms, available in real-time and capturing everything from pricing/hedging to trading factors and specific functions and features. That is why we made sure Agiblocks is a commodity-specific CTRM solution: to match all the intricacies of your particular industry. Or, better yet, all the complexities of your daily routine.”

AgFlow completely agrees: better data means better decision-making. “Risk analysis and risk management are core needs of anyone who wants to trade or hedge on any commodity market”, says Matthews. “For risk managers, traders, and analysts, one of the most significant market risks is failing to read a given situation correctly due to a lack of information or a lack of existing or underlying data. That is why AgFlow developed a machine learning algorithm that fills the data and information gaps in incomplete cash forward curves. Our algorithm generates new synthetic cash forward data points every trading day; each data point is back-tested with real live and historical data to ensure robustness. In other words, you don’t have to miss out on trade signals and opportunities because you don’t have the data in hand and in time to make the right decisions.”

Agents for Efficiency

Quite possibly the most obvious similarity between both companies is the fact we are all agents for efficiency, looking to streamline the daily routine of the commodity trade. Matthews: “Thanks to our API, risk managers finally have an independent, unbiased, and reliable reference point to benchmark their mark-to-market, to challenge trading positions, and to make informed hedging decisions without having to gather all the necessary data.”

RiskMgmt API cuts down many data collection and data analysis tasks, which allows risk management teams to focus on their core activities. AgFlow delivers all cash forward curves before midday (CET), on regular trading days. “This way, our customers have all the data they need directly in their systems well in time to perform their daily mark-to-market and VaR calculations. Furthermore, access is entirely customizable, which means that you select and pay only for the tickers you need.” It’s not only efficient, it’s cost-effective.

“A CTRM system is not just a container for data”, adds Van den Brom. “You need to be able to quickly access and adjust that information as well, and be able to check your position every day. ‘What is going on with this deal, what are my estimates and expectations, how are prices fluctuating?’ When faced with those challenges, you need a solution that allows you to quickly and effectively adjust your position. Agiblocks offers huge efficiency gains by doing just that. The optional addition of AgFlow’s uniquely expansive data stream is a very big next step in tackling redundant and time-consuming tasks of the past.”

About AgFlow

A Geneva-based Swiss physical market data analysis company across Grain, Oilseeds, and Vegoils. AgFlow’s mission is to digitalize agricultural markets. The company is one-of-a-kind in its field and is one of the most trusted names in the agricultural market data analysis industry. To that end, AgFlow provides a platform to keep track of cash prices, import-export flows, and freight indications for Grains, Oilseeds, and Vegoils. AgFlow also provides API access to years of historical data & complete cash forward curves to build forecasting and risk management models. AgFlow serves traders, analysts, risk managers, purchasing managers, among others, globally.

The AgFlow products offer a wide array of data-based features, including on-demand access to real-time all Incoterms price indications – including FOB, CIF, and domestic quotes, trades, freight prices indications, tenders and market reports across Grains, Oilseeds, and Vegoils; as well as real-time vessel line-up data covering over 150 major export ports globally.

Contact

James Matthews, Head of Growth

Email – james.matthews@agflow.com – Head of Growth

Head Office: Rue Abraham-Gevray 6, 1201 Geneva, Switzerland

Website –www.agflow.com

About Agiblocks

Agiblocks is a next generation commodity trade and risk management solution. Agiblocks has been developed in one of the latest (2014) available software architectures, is designed to be accessible for computer (browser) and tablet and is available in the cloud, so you get to quickly keep up with developments and, more importantly, you can work from anywhere.

it is rich in functionalities and supports all the flexibility that characterizes the industry, specialized for a certain commodity or commodity group. Key differentiators of Agiblocks are the configurability, accessibility and functionality specifics for the cocoa, coffee, sugar, cotton and other softs- and agri- commodity industries. Besides its unique technical architecture and advanced features & functionality Agiblocks offers a unique user experience, as the unique architecture, functionality and user interface offer trading companies an attractive alternative for existing CTRM solutions.

Agiblocks offers agile deployment, single server or cloud set up, easy implementation and integration and an attractive total cost of ownership. An additional USP in particular is the fact that Agiblocks will offer, as of January 2021, per-transaction prices. That will instantly open the door for all kinds of smaller businesses. For example, if your company has two transactions a week, but you still need a full CTRM solution, that’s all you’re going to have to pay to use Agiblocks The full range of Agiblocks functionality is available as a demo environment for your browsing leisure. You can easily familiarize yourself with the tools and features of the powerful and agile software solution and find out how you can make the daily practices of commodity trade and risk management more efficient.

Contact

Jan van den Brom, Chief Commercial Officer

Email – jvdbrom@agiboo.com – Chief Commercial Officer

Head Office: Guamstraat 8, 1339 NB Almere, The Netherlands

Website – www.agiboo.com