Hedging against inflation

Hedging is a way for commodity traders, producers and end-users to cover themselves against negative price movements. That is to say, it is an insurance against price changes in any specific […]

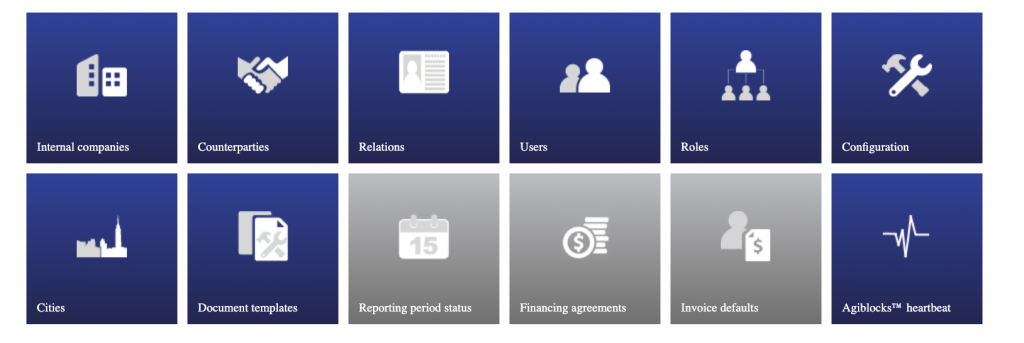

Agiblocks: integrated physical trading, hedging, logistics and more – much more

A commodity trading and risk management solution provides a number of features and functions specialized for commodity traders and purchasers. Agiblocks integrates all these essential functions in one solution to […]

Why do commodity traders hedge?

In the context of the complexities of the commodity trade, we’ve recently talked about the question ‘what is it that you exactly do?’. Which is something you might be asked […]

Agiblocks Tutorial 1.4: Futures and Hedging Instruments

What are possible risks during a commodity trade, and can we do something about it? Yes, we can! In our Agiblocks tutorials, we show you all you need to know, […]

Hedging 101: hedging with agricultural options

Commodity traders – as well as most other traders – tend to be risk averse. That is to say, they prefer situations with low uncertainty over situations with high uncertainty. […]

IFRS 9 replaces IAS39 as from 2018

As from January 1st 2018 it will become mandatory to replace accounting standard IAS 39 (Revenue and Recognition) by IFRS 9 (Financial assets). IFRS 9 is predominantly applicable for banks […]